Bitcoin in Discovery Mode Safeguarding Miners Revenue

Mining Economics, Trends and Insights

Bitcoin has broken through to new all-time highs, riding a wave of macroeconomic tailwinds and renewed institutional momentum. ETF flows have surged back, propelling BlackRock’s $IBIT into the ranks of the top 20 U.S. ETFs by AUM. Meanwhile, Tether continues to grow its treasury to 86,335 BTC, while Bitcoin mining stocks collectively hit their highest market capitalization since early 2023. Difficulty growth has caught up with 2024’s pace, and hashrate has held above 1 ZH/s for over a month, setting a new baseline.

Macroeconomic Tailwinds Push Bitcoin to New All-Time High

ETF Flows Rebound Sharply

$IBIT Joins ETF Elite

Tether Expands Treasury to 86,335 BTC

Bitcoin Mining Stocks Total Market Cap Reaches New High

Average Monthly Difficulty Growth Catches Up to 2024

Sustained Hashrate Above 1 Zetahash Marks a New Baseline

👉 Premium members get exclusive access to forward-looking hashrate and hashprice projections through 2026, including aggressive, moderate, and conservative growth scenarios.

NiceHash is more than just a mining pool. Unlike FPPS and other pools, it is the world’s only spot hashrate marketplace – where hashrate can be bought on demand. This unique model means hashrate pricing isn’t tied to the FPPS index, giving you the chance to earn more for your hashrate than anywhere else.

Macroeconomic Tailwinds Push Bitcoin to New All-Time High

Over the weekend, Bitcoin broke through the $125,000 mark for the first time in history. In just nine days, BTC rallied nearly 16%, adding more than $17,000 in value. This surge to new all-time highs has been fuelled by a mix of macroeconomic tailwinds. The recent U.S. government shutdown, a weaker dollar, and a broad rally in risk assets have all played a role. The S&P 500 has climbed more than 40% in the past six months, while gold is also trading at record levels approaching the $4,000 threshold.

Bitcoin and gold are rising in tandem with equities as the U.S. dollar heads for its worst annual performance since 1973, highlighting a broader shift in capital toward hard assets and risk markets.

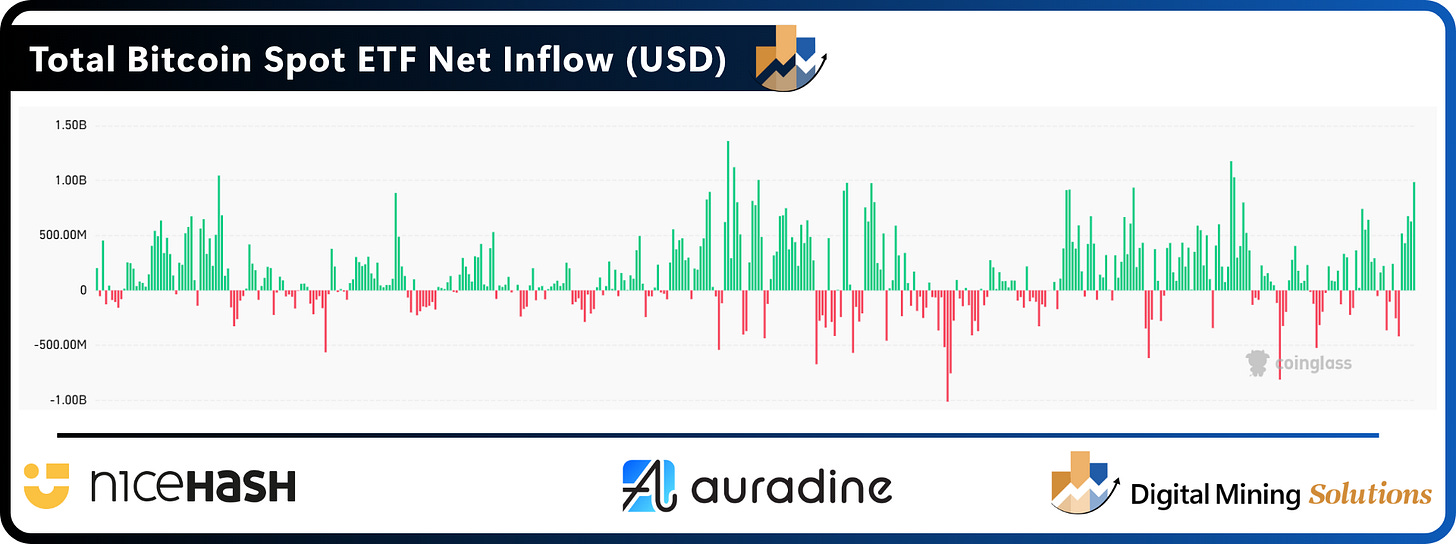

ETF Flows Rebound Sharply

U.S.-listed spot Bitcoin ETFs have reignited investor enthusiasm. On October 3rd, the products recorded $985 million in net inflows, the third-largest single-day inflow of the year. This sharp reversal ended a brief period of outflows and set a bullish tone for the month.

Over the past week, Bitcoin ETFs attracted more than $3.23 billion in net inflows, marking their second-largest weekly total on record, just behind the $3.37 billion peak in November 2024. These strong inflows pushed total Bitcoin ETF assets under management (AUM) above the $160 billion mark for the first time, underscoring growing institutional demand and the sector’s expanding footprint in traditional finance.

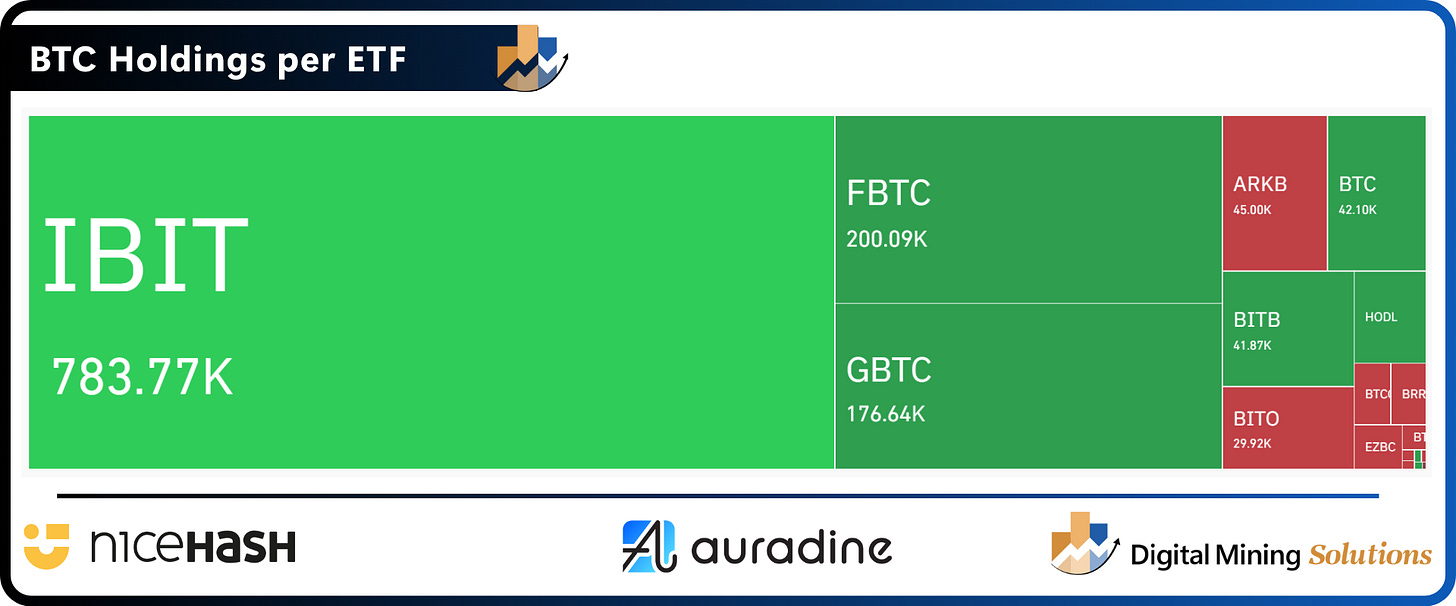

BlackRock’s iShares Bitcoin Trust (IBIT) led the charge with $1.78 billion in inflows, followed by Fidelity’s FBTC with $692 million. Ark 21Shares added $254 million, while Bitwise captured another $212 million.

$IBIT Joins ETF Elite

Earlier this year, BlackRock’s iShares Bitcoin Trust ($IBIT) set a historic milestone by becoming the fastest ETF ever to surpass $70 billion in assets under management, achieving this feat just 341 days after launch.

Now, $IBIT has officially entered the top 20 U.S. ETFs by AUM, reaching $95.92 billion in net assets. For context, this places $IBIT just below Vanguard Dividend Appreciation ETF (VIG) at $98 billion and above the Technology Select Sector SPDR Fund (XLK) at $90.6 billion, both long-standing giants in traditional finance. Analysts estimate that if current inflow trends continue, $IBIT could break into the top 10 ETFs by December 2026, cementing Bitcoin’s role in mainstream investment portfolios.

BlackRock currently holds 783,770 BTC, nearly four times the amount held by the runner-up ETF, Fidelity’s FBTC, and over 140,000 BTC more than Strategy’s 640,031 BTC, underscoring its dominant position in the Bitcoin ETF landscape.

Auradine’s Teraflux™ lineup includes the AT2880 air-cooled, AH3880 hydro-cooled, and AI3680 immersion-cooled miners engineered for performance, resilience, and flexibility. Each system is designed to maximize efficiency across environments and paired with advanced ASICs and software to deliver reliable output and industry-leading lower total cost of ownership.

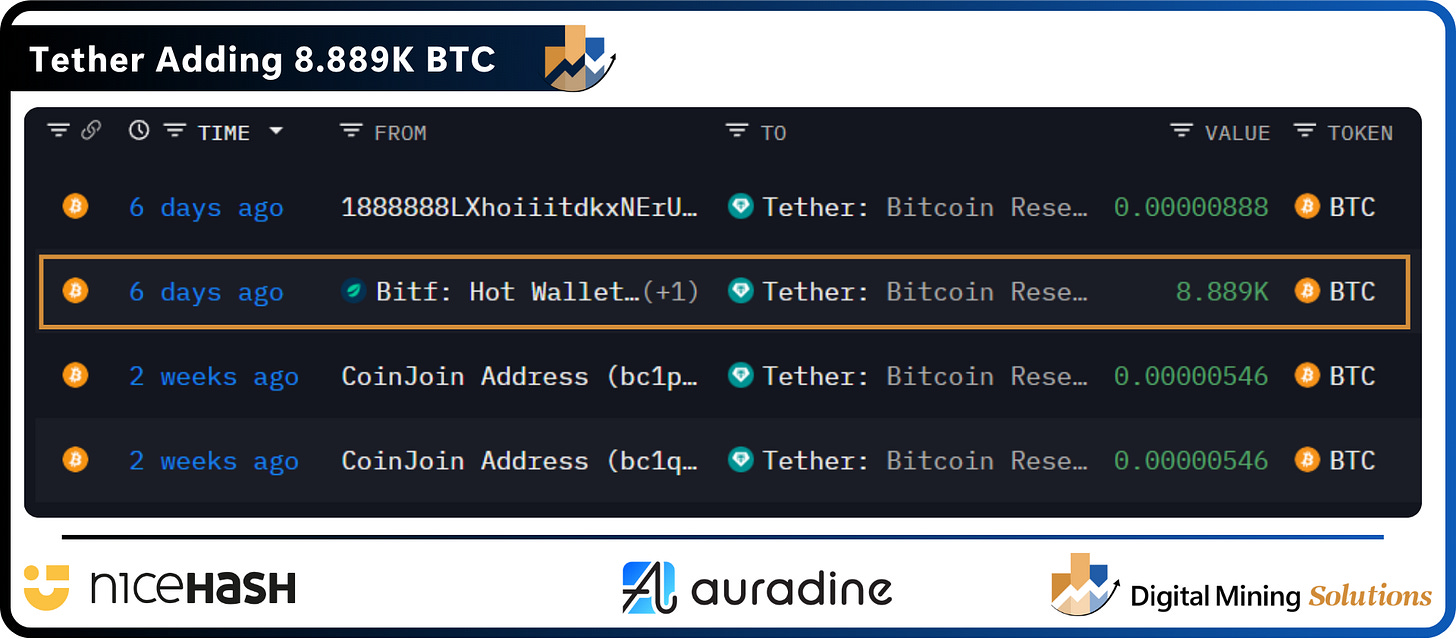

Tether Expands Treasury to 86,335 BTC

Stablecoin issuer Tether has made a significant addition to its corporate Bitcoin treasury. On September 30, Tether transferred 8,888.889 BTC to its primary treasury address, according to on-chain data from Arkham. This brings its total holdings to 86,335.46 BTC. This puts Tether above MARA Digital, the world’s largest public Bitcoin holder among miners.

Meanwhile, MARA broke its 16-month “full HODL” streak by selling part of its monthly production for the first time in over a year. In its September update, the company revealed it liquidated 49.32% of the 736 BTC it mined during the month. As of the end of September, MARA holds 52,850 BTC on its balance sheet.

Bitcoin Mining Stocks Total Market Cap Reaches New High

The total market capitalization of publicly listed Bitcoin mining companies has surged to nearly $80 billion, reaching its highest level since February 2023.

This milestone highlights growing investor confidence in the sector, fuelled by bullish Bitcoin price action, a wave of AI/HPC partnership announcements, and continued infrastructure build-outs. Trading volumes have climbed in parallel, reflecting both institutional and retail participation, as mining stocks increasingly act as a leveraged proxy for Bitcoin itself.

IREN leads the pack with a 13.71% market share and a valuation of over $10 billion. Bitmine Immersion Technologies follows closely, boasting a market cap just under $10 billion and a 12.42% share. Riot, MARA, and Applied Digital round out the top five. Collectively, these five companies account for 52.84% of the total market capitalization of all publicly traded Bitcoin miners.

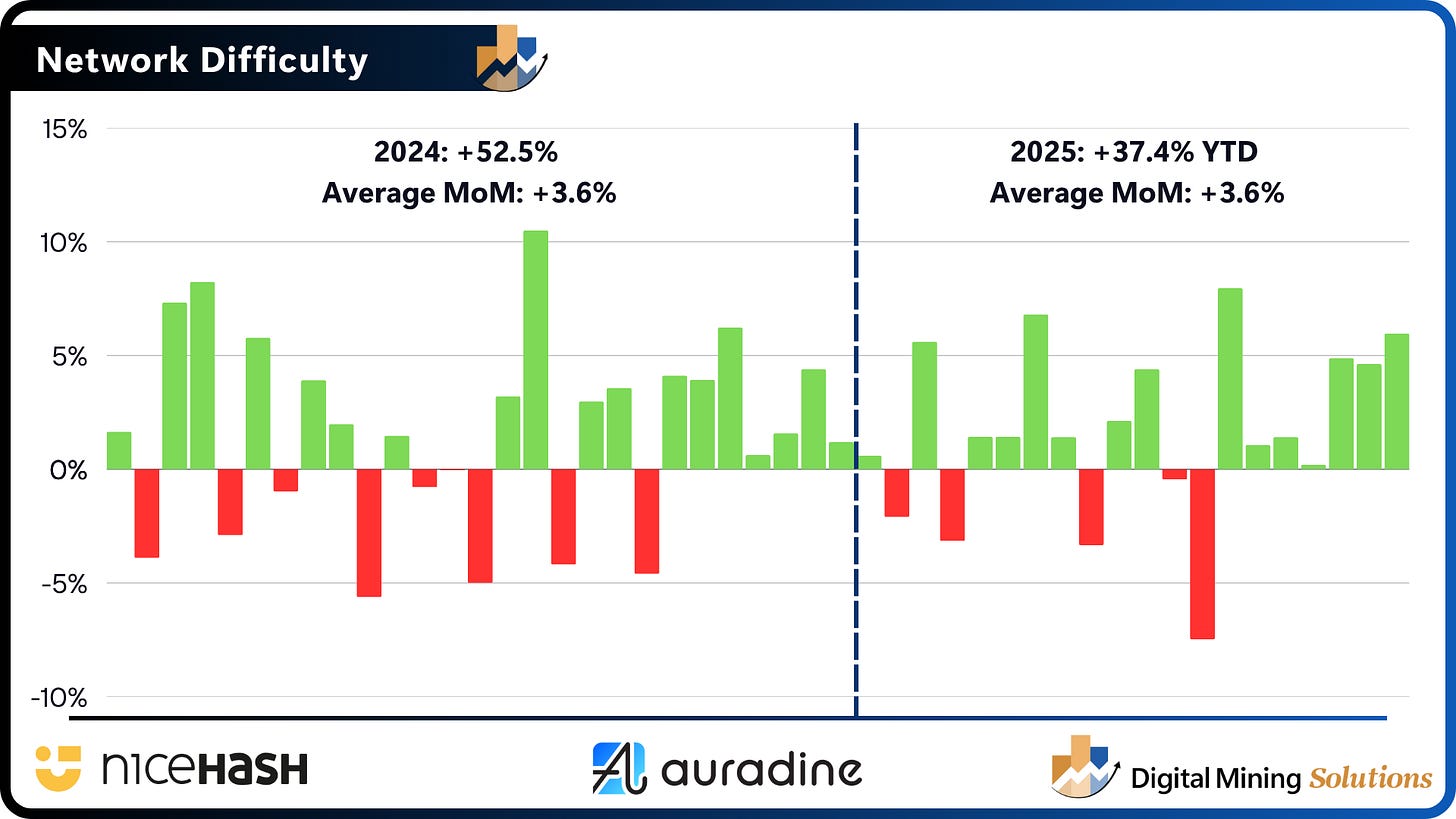

Average Monthly Difficulty Growth Catches Up to 2024

For the first time this year, Bitcoin’s average month-over-month difficulty growth has matched 2024 levels, underscoring the persistent strength of hashrate expansion throughout 2025. Last week, network difficulty rose another 5.97%, setting a new all-time high of 150.84 T and marking the 7th consecutive upward adjustment.

Year-to-date, difficulty is up 37.4%, reflecting sustained deployment of new-generation machines and infrastructure build-outs despite ongoing margin pressure. Fortunately, bullish BTC price action has provided some breathing room for miners, pushing hashprice back above $50 / PH / day.

Sustained Hashrate Above 1 Zetahash Marks a New Baseline

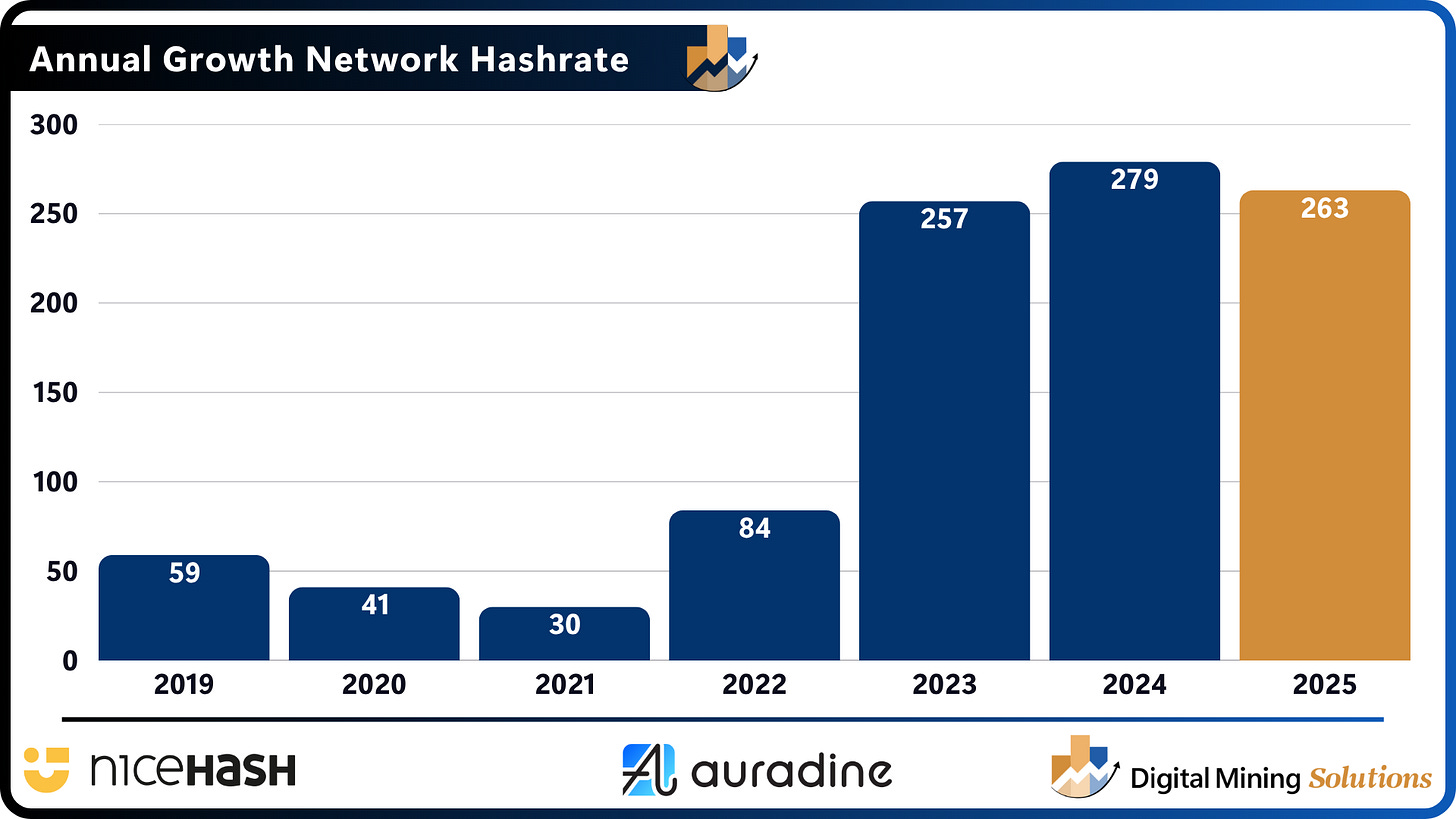

The aggressive growth in network difficulty should come as no surprise to those closely tracking hashrate trends. The 7-day moving average has remained above the 1 ZH/s (zettahash) level for over a month, and growth has become noticeably more stable. Since the start of Q3, the network hashrate has no longer experienced the sharp +100 EH/s swings that characterized the first half of the year, signaling a more consistent expansion phase.

Currently, the network is just 16 EH/s away from matching 2024’s nominal hashrate growth of 279 EH/s. Whether this rapid pace continues into year-end remains to be seen. To match last year’s percentage growth of 54.1%, the network would still need to add an additional 173 EH/s, closing 2025 at around 1,223 EH/s.

Premium Insight: Network Hashrate Growth Into 2026

Where is Bitcoin’s network hashrate headed next and what does that mean for future hashprice levels?

In our latest Premium Analysis, we break down historic network hashrate data and model three forward-looking hashrate growth scenarios — Aggressive, Moderate, and Conservative — and calculate the Bitcoin price levels required to sustain hashprice through the end of 2026.

This is strategic intelligence for miners, investors, and treasury managers looking to plan ahead with clarity. 🔐 Upgrade to Premium to access the full hashrate growth model and hashprice projections.

New York Targets Bitcoin Mining with Proposed Tax Hike Bill

Canaan Inc. Secures Landmark U.S. Order of +50,000 A15 Pro’s

Asia Investors the New Bagholders in Bitcoin Mining?

Soluna and Canaan Inc. Partner to Deploy 20 MW of Next-Gen Bitcoin Miners at Wind-Powered Data Center in Texas

ICE raids bitcoin mine in Pyote, Texas

Leverage data-driven insights and a powerful network to launch strong, optimize efficiently, and scale with confidence. We offer:

Market Intelligence - Masterclasses, Tailored Reports & Articles and Industry Benchmarks.

Advisory Services - Business Plan Assessment, Investor Presentations, M&A Advisory and Executive Coaching.

Sites & Rackspace - Due Diligence & Partnership Matchmaking, Institutional Investment Guidance and Rackspace Sales

Elevate your mining operation today with Digital Mining Solutions!

If you enjoy the content, if you have not subscribed, please ensure to click the button below and share The Bitcoin Mining Block Post.

If you want to stay ahead in the world of Bitcoin mining, make sure to follow me on Twitter and LinkedIn. Would you like to become a sponsor of the newsletter or are you interested in a workshop on mining economics? Contact me at nicosmid@digitalminingsolutions.tech.