Bitcoin on the Balance Sheet: Treasury Strategies for Miners

How top players preserve Bitcoin and unlock growth

While public companies like MicroStrategy make headlines, it was Bitcoin miners who first pioneered the idea of holding BTC on balance sheets. In this issue, we explore how treasury strategy has evolved beyond simple hodling into a sophisticated, capital-efficient tool. From convertible debt to BTC-backed ASIC purchases, we cover four creative capital strategies. And for premium members, we unpack how private miners can preserve their treasuries without selling BTC. In a post-halving world, capital efficiency isn’t just an advantage, it’s survival.

Corporate Bitcoin Treasury

Bitcoin Miners The Original Bitcoin Treasurers

Bitcoin Treasury Strategy vs. Hodling

Intent and Function

Active Management

Risk and Reporting

Four Creative Capital Strategies

Convertible Notes: Long-Term Debt with Equity Upside

Bitcoin as Collateral

BTC-Backed ASIC Purchases

At-the-Market (ATM) Offerings

Capital Efficiency Is the New Competitive Advantage

Premium Members Only:

How Private Miners Can Preserve Their Bitcoin Treasuries

Generate Liquidity Without Selling BTC

Diversify Income Streams

Dynamic Mining Strategies

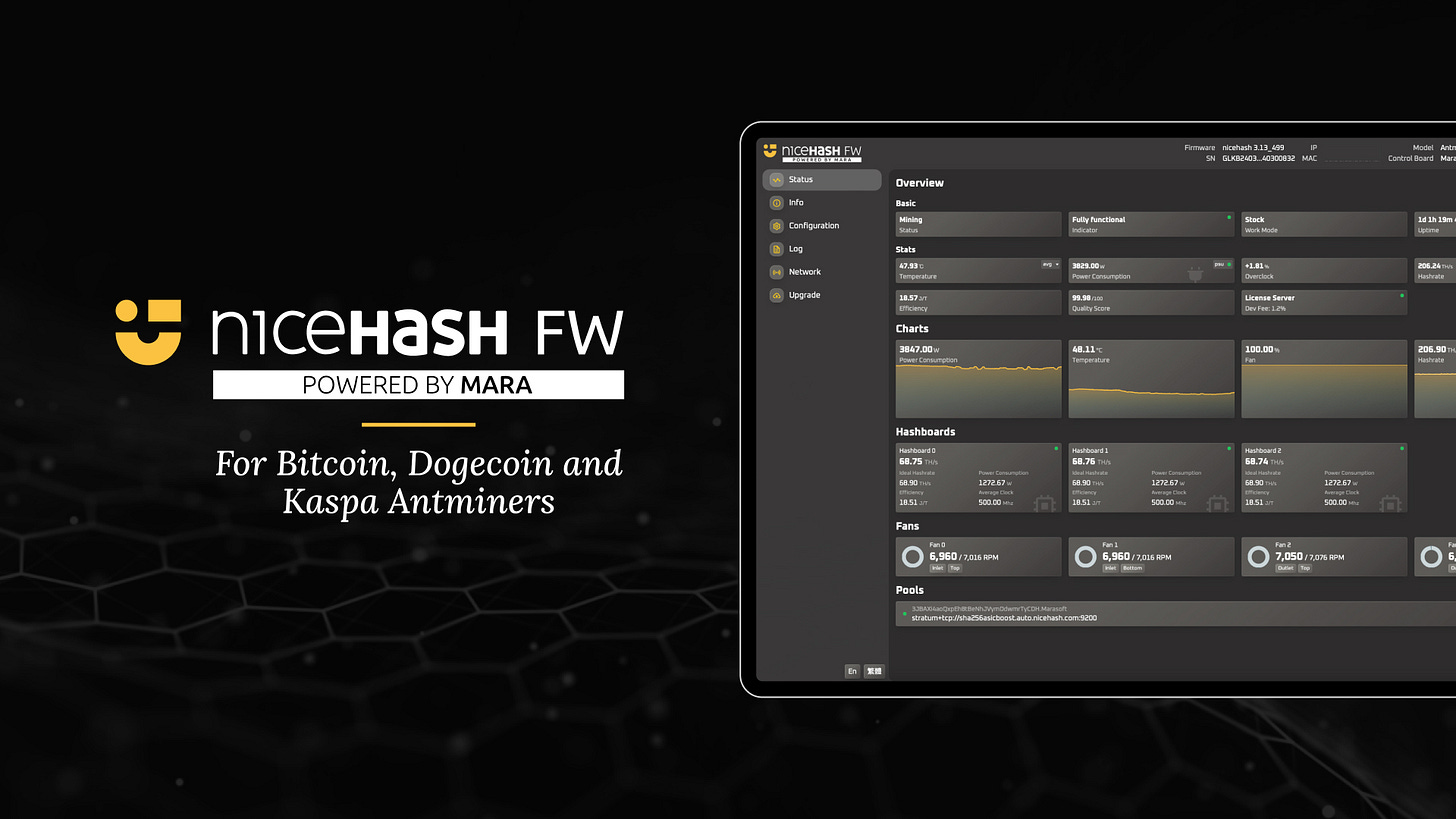

Boost your ASIC mining with NiceHash Firmware, powered by MARA!

Get the highest efficiency and lowest fees - just 1.4% when mining on NiceHash. Unlock elite mining technology for your Bitcoin (S19, S21 series) and Kaspa (KS5, KS3) Antminers. Supports air, hydro, and immersion cooling.

Corporate Bitcoin Treasury

A corporate treasury encompasses a company's financial assets, such as cash, stocks, and other investments. Traditionally, businesses have safeguarded surplus funds by allocating them to low-risk instruments like government bonds or money market accounts, with the goal of preserving capital and maintaining liquidity.

However, a growing number of companies are now turning to Bitcoin as an alternative asset for their treasuries, a trend that is accelerating rapidly. According to Standard Chartered, 61 publicly listed companies now hold a combined 673,897 BTC, representing 3.2% of all Bitcoin that will ever exist.

In just the past two months, these firms have doubled their holdings, outpacing even the famously aggressive Bitcoin accumulation strategy of Michael Saylor’s MicroStrategy, which added 74,000 BTC in the same period. Notably, many of these new entrants bought at an average price exceeding $90,000 per BTC, significantly higher than Saylor’s $70,023 average.

New adopters such as Canada’s SolarBank and France’s Blockchain Group highlight that corporate interest is broadening across industries and geographies. And while the report tracks 61 public firms, the actual number of companies holding Bitcoin is much higher when considering private entities, suggesting a broader and deeper shift in treasury management.

Bitcoin Miners The Original Bitcoin Treasurers

Bitcoin miners are the “OGs” of Bitcoin treasuries because they were the first entities to accumulate Bitcoin as part of their core operations. Unlike most companies that acquire Bitcoin by purchasing it on the open market, miners earn newly minted Bitcoin directly from block rewards. This means they naturally build up Bitcoin reserves over time, often holding a portion of their mined coins on their balance sheets.

Long before public companies began allocating to Bitcoin, miners were already managing their capital in BTC, using it to fund operations, hedge risk, and sometimes as collateral. In that sense, Bitcoin miners pioneered the idea of a Bitcoin-based corporate treasury.

Bitcoin Treasury Strategy vs. Hodling

A Bitcoin treasury strategy differs from simply hodling in its purpose, structure, and risk management approach. These are three key distinctions:

1. Intent and Function

Hodling is typically a passive, long-term investment strategy driven by belief in Bitcoin’s future value. It is often emotional and ideological. A Bitcoin treasury strategy, on the other hand, is an intentional financial decision made by a business to allocate Bitcoin as part of its broader capital management plan. It’s about balancing growth potential with liquidity, risk, and operational needs. A treasury strategy can signal innovation, hedge against fiat debasement, attract Bitcoin-aligned customers or investors, and even enhance financial resilience.

2. Active Management

Hodlers usually buy and hold Bitcoin without much consideration for timing or portfolio impact. Treasury strategies are actively managed. Companies may decide what portion of reserves to hold in Bitcoin, how to custody it, whether to hedge exposure, or how to use it as collateral or working capital.

3. Risk and Reporting

Individual holding can afford volatility and often ignore short-term price swings. Corporate treasuries must account for volatility, regulatory compliance, accounting standards, and stakeholder expectations. They often use risk-adjusted frameworks and may rebalance or limit exposure accordingly.

Four Creative Capital Strategies

The 2024 halving has forced Bitcoin miners to get leaner and smarter with their capital strategies. With hashprice remaining under pressure, some of the industry's biggest players are tapping into diverse and increasingly creative fundraising strategies to unlock capital and fuel growth, without immediately selling their Bitcoin reserves.

1. Convertible Notes: Long-Term Debt with Equity Upside

A convertible note is like a loan that can turn into stock later. Companies use it to raise money without immediately giving up ownership (equity). It’s a tool that blends the features of both debt and equity: the company gets cash now, and investors get the option to become shareholders later, usually at a premium if things go well.

In June 2025, Cipher Mining used this strategy to raise $150 million, with an extra $22.5 million available if investor demand is strong. These were convertible senior notes, meaning they are loans that mature in 2030 and take priority over other types of debt but can be turned into Cipher shares by the investors.

The notes can convert into Cipher stock at a 30% premium to the current share price. That means investors believe the company’s value will grow and are willing to wait for potential upside. Cipher doesn’t have to give away stock today at low prices, reducing the immediate impact on existing shareholders.

2. Bitcoin as Collateral

Instead of selling their Bitcoin to raise money, some miners like Riot Platforms and CleanSpark are borrowing cash using their Bitcoin as collateral. This is called a Bitcoin-collateralized credit line. This is basically a loan secured by Bitcoin they already own.

Riot Platforms increased its borrowing limit with Coinbase Credit to $200 million. They put up some of their Bitcoin holdings as a “security deposit” for the loan. CleanSpark did the same, borrowing U.S. dollars against their Bitcoin to fund daily operations and buy more mining machines.

Because they’re using Bitcoin as collateral, they don’t have to sell any coins. That means no immediate tax bills and no selling pressure on the Bitcoin market. Plus, unlike issuing new shares (which dilutes ownership), this approach lets miners get cash while keeping control of their company. The loan terms include interest payments.

3. BTC-Backed ASIC Purchases

Miners often upgrade newer machines or expand their mining fleet to stay competitive. But those rigs are expensive and paying cash means giving up valuable Bitcoin or raising new capital.

To solve this, companies like HIVE and CleanSpark have come up with a creative way to fund ASIC purchases using their Bitcoin holdings, without permanently giving them up. Instead of selling Bitcoin, they pledge it to the equipment supplier (like Bitmain) at a high fixed price, higher than the market price. In return, they get ASICs now, and secure the right to buy their Bitcoin back later at that same high price.

HIVE pledged BTC at $87,000 per coin (while market prices were lower), allowing them to get machines now and still retain potential upside through a built-in call option which provides the right to repurchase their coins later. CleanSpark pledging 691 BTC at an effective price of $110,900 per coin. That gives them the option to reclaim those same BTC later, if the price rises above that level.

This strategy reduces the need for upfront dollars, it lets miners keep exposure to Bitcoin's future gains. It creates win-win deals with suppliers: the miner gets better terms on rigs, while suppliers like Bitmain compete by accepting BTC at a premium and structuring the deal with upside potential.

4. At-the-Market (ATM) Offerings

Instead of doing big one-time stock sales, miners like Bit Digital and HIVE have been using at-the-market (ATM) offerings. Selling small amounts of stock directly into the market, whenever conditions are favourable.

Bit Digital filed to raise up to $500 million this way, helping fund its expansion into cloud and HPC. HIVE extended its own ATM program to raise another $119.2 million, aiming for 25 EH/s in hashrate. ATMs offer flexibility and speed, but they do dilute existing shareholders over time. Still, it’s a go-to method for miners looking to scale.

Capital Efficiency Is the New Competitive Advantage

Miners like Cipher are pioneering layered capital strategies, blending equity with convertible debt to optimize cost of capital, preserve strategic flexibility, and delay dilution until share prices improve. This hybrid approach reflects a growing maturity in the sector, as miners adopt institutional-grade capital stack management.

For publicly traded mining companies, creativity in capital structuring is becoming just as critical as access to cheap power and efficient machines. The miners who master the game of raising funds without sacrificing long-term upside, will be best positioned to scale, secure favourable deals with vendors, and thrive in the post-halving landscape. Expect these financial engineering tactics to become standard tools in the modern miner’s playbook.

The following content is exclusively for our Premium Members:

How Private Miners Can Preserve Their Bitcoin Treasuries

For private Bitcoin miners, preserving BTC on the balance sheet while covering daily expenses is a delicate balancing act, especially without the deep capital markets access that public miners enjoy. Without equity issuances or institutional credit lines, private operators need to get creative. Here are three ways how savvy miners are maintaining their BTC holdings while still keeping the lights on.

Leverage data-driven insights and a powerful network to launch strong, optimize efficiently, and scale with confidence. We offer:

Market Intelligence - Masterclasses, Tailored Reports & Articles and Industry Benchmarks.

Advisory Services - Business Plan Assessment, Investor Presentations, M&A Advisory and Executive Coaching.

Sites & Rackspace - Due Diligence & Partnership Matchmaking, Institutional Investment Guidance and Rackspace Sales

Elevate your mining operation today with Digital Mining Solutions!

If you enjoy the content, if you have not subscribed, please ensure to click the button below and share The Bitcoin Mining Block Post.

If you want to stay ahead in the world of Bitcoin mining, make sure to follow me on Twitter and LinkedIn. Would you like to become a sponsor of the newsletter or are you interested in a workshop on mining economics? Contact me at nicosmid@digitalminingsolutions.tech.