Bitcoin briefly dipped below the $100K mark over the weekend, reacting to geopolitical tensions, but quickly regained its footing. Despite the rebound, one thing remains clear: transaction fees aren’t doing much to support miner revenue, and hashprice continues to closely track BTC’s every move. We also take a closer look at the recent decline in network hashrate and how seasonal factors may be playing a role. For premium members, this issue includes a deep dive into curtailment strategies, demand response programs, and how miners in Texas can significantly reduce power costs by participating in 4CP.

Bitcoin Dips Below $100K and Snaps Back Fast

Fees Aren’t Picking Up the Slack

Hashprice Tracks BTC Price Closely

Network Hashrate Falls Below 900 EH/s

Hashrate Seasonality

Premium Members Only:

What Is Curtailment and Why Do Miners Do It?

Demand Response Programmes Explained

How Texas Miners Can Save Big with 4CP

NiceHash - More than a mining pool!

Miners on NiceHash have earned 3.2% more than on other leading FPPS Bitcoin mining pool.

Connect your ASIC machine to NiceHash and earn more!

Bitcoin Dips Below $100K and Snaps Back Fast

Bitcoin briefly dipped below $100,000 this weekend following reports that the U.S. launched a surprise strike on Iranian nuclear sites. As the only major asset that trades 24/7, BTC absorbed the geopolitical shock in real time, sliding as much as 6% to touch $98,000 on Sunday.

Given the scale of the news and Bitcoin’s sensitivity to global risk events, the pullback was relatively modest. Panic sellers logged in, market makers adjusted, and by early Monday, BTC had reclaimed the $100K mark.

Where it goes from here will largely depend on how the conflict in the Middle East unfolds. Meanwhile, all eyes shift back to macro this week, with Fed Chair Jerome Powell set to testify before the Senate. Expect his comments on interest rates and the broader economy to stir volatility across risk assets, including Bitcoin.

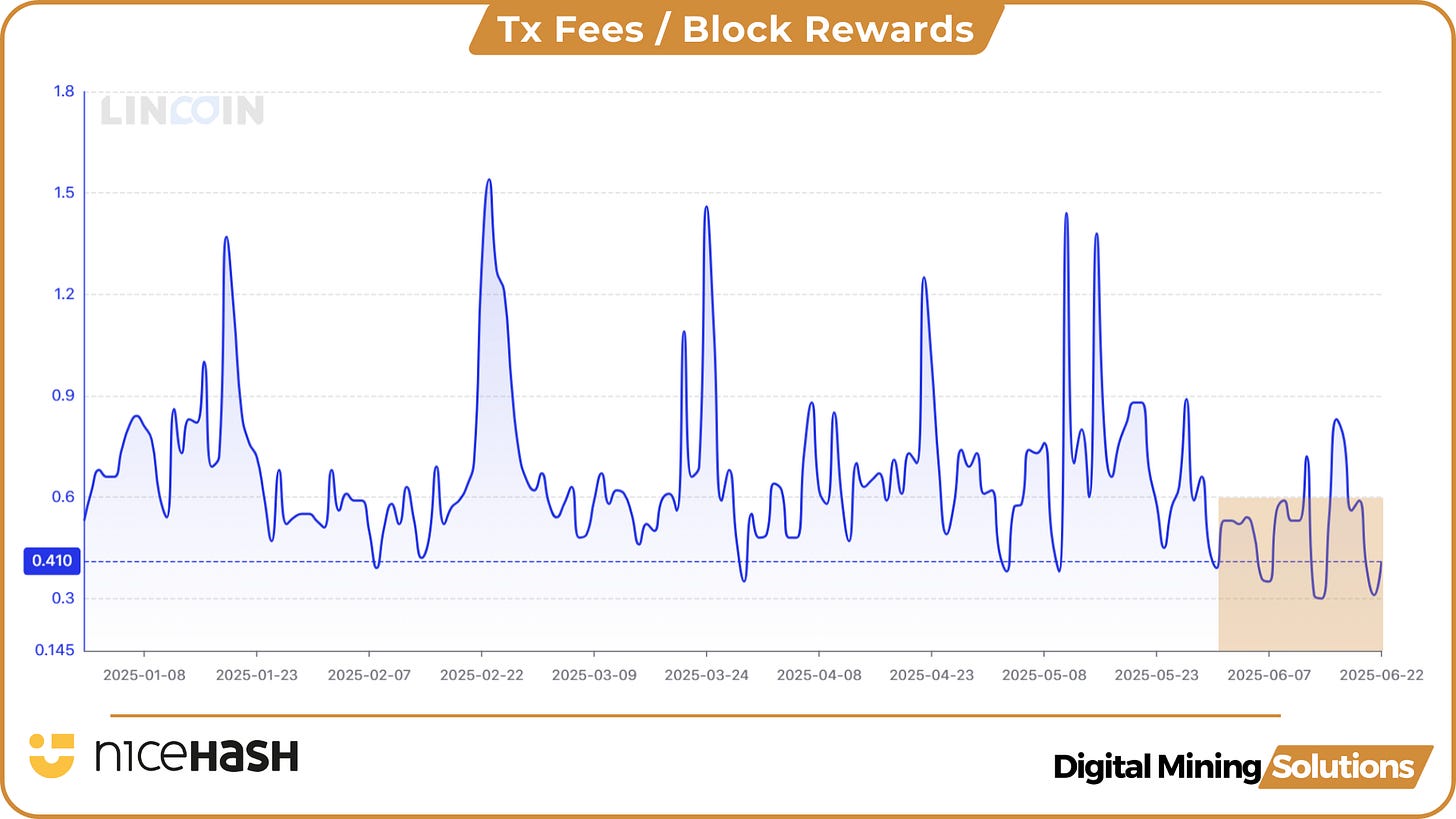

Fees Aren’t Picking Up the Slack

One of the core ideas behind Bitcoin’s design is that, over time, transaction fees will gradually replace the block subsidy as the primary incentive for miners. Every halving cuts the subsidy in half, putting more pressure on fees to make up the difference. But in 2025, that principle isn’t playing out as expected. While there was a brief spike in mid-May, activity has cooled off sharply since then. In June there were only two short spikes whereby transaction fees rose above the 1% of the total block reward.

2025 has not yet been the year where fees are stepping in to surpass the subsidy. For that to happen, Bitcoin needs more demand for on-chain settlement, whether from financial institutions, base-layer applications, or another wave of speculative mania.

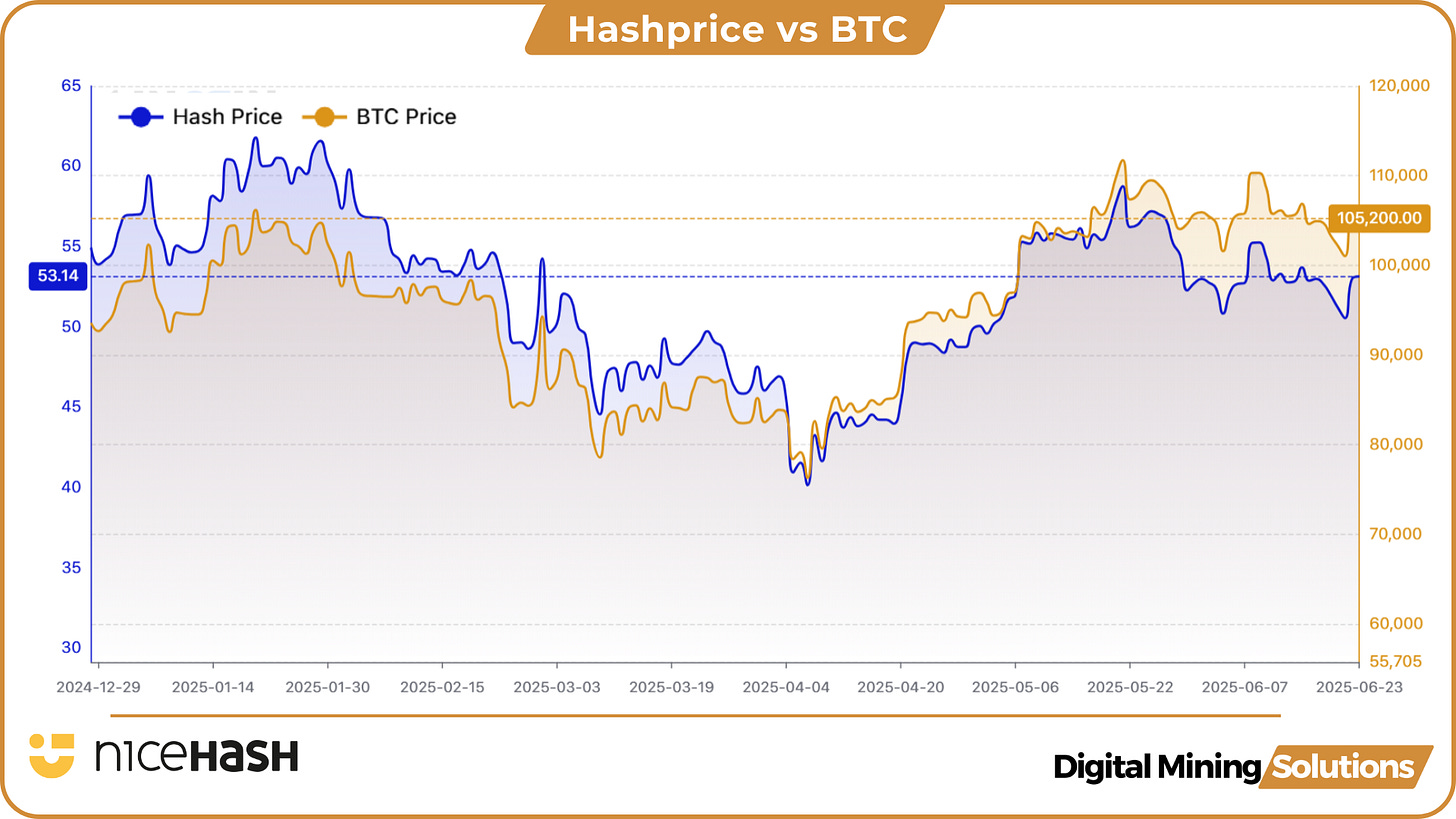

Hashprice Tracks BTC Price Closely

With transaction fees making up less than 1% of the block reward, the value of mining Bitcoin, measured as hashprice (USD earned per PH per day), is currently driven almost entirely by the block subsidy. That means hashprice is now highly correlated to the price of Bitcoin itself.

In a low-fee environment, when the BTC price moves, miner revenue moves in lockstep. The recent drop in Bitcoin’s price resulted in hashprice nearing the $50/PH/day level, fees don’t provide any cushion or amplification at the moment.

Difficulty adjustments, which occur roughly every two weeks, also impact hashprice, but to a lesser extent and with a lag. If the hashrate rises sharply, difficulty adjusts upward, reducing revenue per unit of hash. But these adjustments are incremental compared to the daily volatility of BTC/USD. So until transaction fees start making up a larger share of the total reward, hashprice will remain tightly tethered to Bitcoin’s price.

Network Hashrate Falls Below 900 EH/s

Bitcoin’s network hashrate has been highly volatile in 2025, with sharp swings and multiple record highs. After peaking at 929 EH/s in early April, the hashrate dropped 12% to a monthly low of 817 EH/s, the steepest decline of the year, and only the third time in Bitcoin’s history that it fell by more than 100 EH/s.

May and June continued this rollercoaster pattern, with three more all-time highs, each followed by a steep pullback. On June 13th, the network hit a new record of 950 EH/s, only to drop again, falling decisively to 827 EH/s. The 123 EH/s or 13%. drop is even steeper than we saw in April.

With summer temperatures rising across the U.S., it remains to be seen whether network hashrate will continue to set new records in July and August, or if we’ll see the typical seasonal slowdown.

Hashrate Seasonality

Roughly 36% of all global Bitcoin mining happens in the United States, and by most estimates, about half of that takes place in Texas. The Lone Star State has become a mining mining hub thanks to its competitive electricity prices, abundant renewable energy, and deregulated market structure.

Over the past few years, we’ve seen a distinct seasonality in the Bitcoin network’s hashrate. When temperatures spike during the summer months in the U.S. and specifically in Texas, hashrate growth often stalls or even dips. Why? Because mining companies in ERCOT curtail operations during periods of extreme heat and high power demand. These curtailment events are visible not just in ERCOT load charts but in the Bitcoin network itself. When miners in Texas power down, global hashrate dips.

The following content is exclusively for our Premium Members:

What Is Curtailment and Why Do Miners Do It?

Demand Response Programmes Explained

How Texas Miners Can Save Big with 4CP

CleanSpark Reaches 50 EH/s Milestone

Canaan Exits AI Semiconductor Business, Targets 15% Operating Expense Cut to Double Down on Bitcoin Mining

Norway Plans to Temporarily Ban New Bitcoin & Crypto Mining Centers to Conserve Energy

Riot sells $5.67M in Bitfarms shares, all sales now total $14.25M

Dominant Chinese makers of bitcoin mining machines set up US production to beat tariffs

MARA Taps Auradine for Half of 2025 Bitcoin Mining Rig Orders

Leverage data-driven insights and a powerful network to launch strong, optimize efficiently, and scale with confidence. We offer:

Market Intelligence - Masterclasses, Tailored Reports & Articles and Industry Benchmarks.

Advisory Services - Business Plan Assessment, Investor Presentations, M&A Advisory and Executive Coaching.

Sites & Rackspace - Due Diligence & Partnership Matchmaking, Institutional Investment Guidance and Rackspace Sales

Elevate your mining operation today with Digital Mining Solutions!

If you enjoy the content, if you have not subscribed, please ensure to click the button below and share The Bitcoin Mining Block Post.

If you want to stay ahead in the world of Bitcoin mining, make sure to follow me on Twitter and LinkedIn. Would you like to become a sponsor of the newsletter or are you interested in a workshop on mining economics? Contact me at nicosmid@digitalminingsolutions.tech.