Bitcoin is nearing a new all-time high as corporate demand continues to rise globally. Meanwhile, the Bitcoin network saw its biggest difficulty drop since the China ban, offering relief to miners. The worst of the summer curtailments seem to be behind us as hashrate stabilizes just below 900 EH/s. Furthermore, two miners join the +50 EH/s club, Tether pushes to become the largest miner with a Latin American footprint, and altcoins are entering corporate treasuries.

Bitcoin Eyes New All-Time High as Corporate Demand Continues

Network Hashrate Stabilizes Just Below 900 EH/s

Biggest Difficulty Drop Since China Ban Brings Relief to Bitcoin Miners

Cango and IREN Join the +50 EH/s Club

Tether Targets the Top Spot With a Latin American Footprint

Are We Witnessing a Corporate Treasury Altseason?

Premium Members Only:

100% Bonus Depreciation Is Back, Here’s Why Bitcoin Miners Should Care

NiceHash - More than a mining pool!

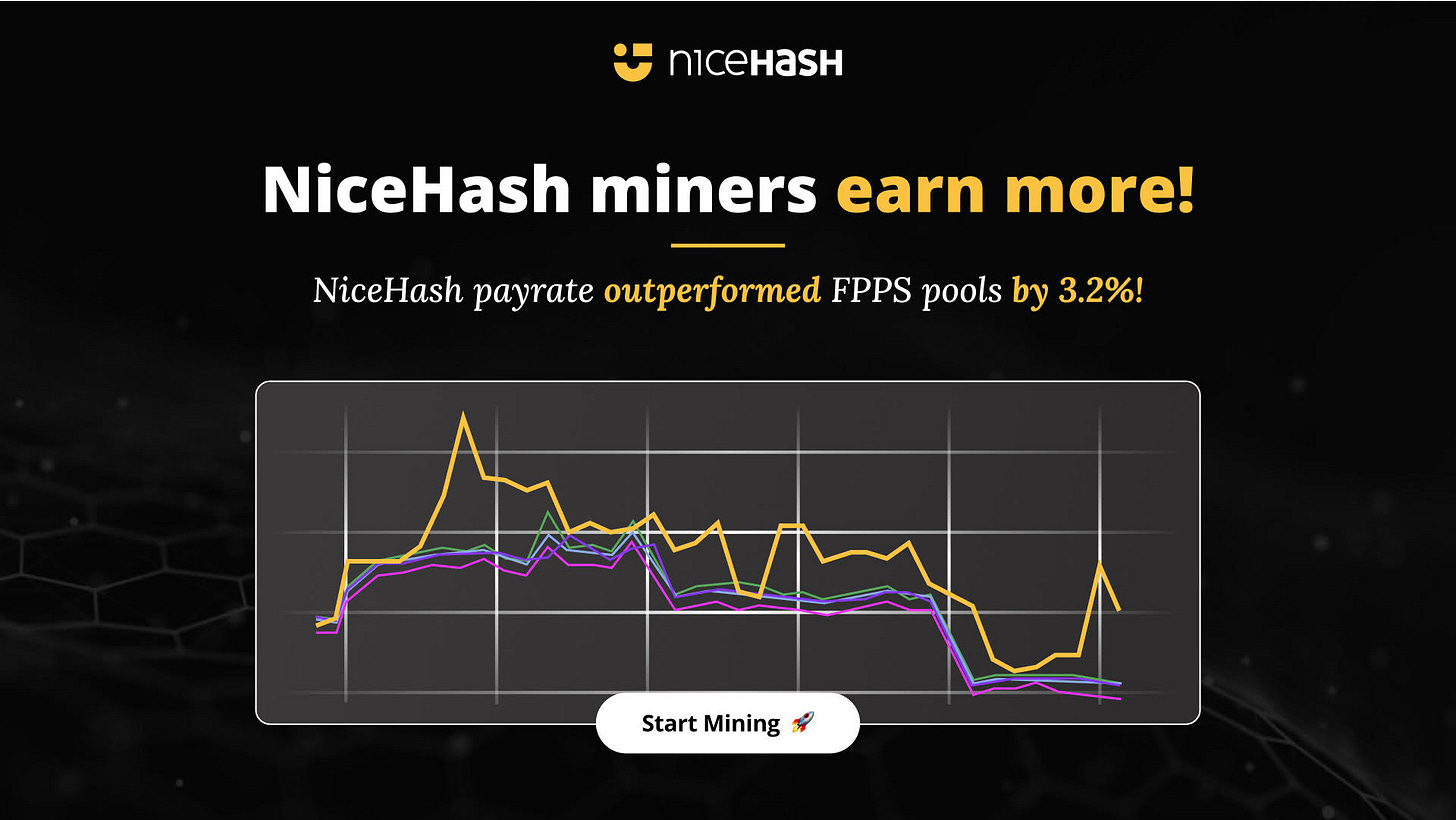

Miners on NiceHash have earned 3.2% more than on other leading FPPS Bitcoin mining pool.

Connect your ASIC machine to NiceHash and earn more!

Bitcoin Eyes New All-Time High as Corporate Demand Continues

Bitcoin is once again approaching the $110,000 mark after two previous rejections, putting a new all-time high within striking distance. With corporate buying continuing globally, the momentum is building.

Strategy reported a massive $14 billion in unrealized gains on its Bitcoin holdings in Q2 and announced a new $4.2 billion ATM offering to fuel further accumulation. Meanwhile, international firms are stepping up their own treasuries. France’s Blockchain Group added 116 BTC in early July, raising its total to 1,904 BTC. Japan’s Metaplanet boosted its stack to 15,555 BTC, aiming for 30,000 BTC by year-end. In the UK, Smarter Web Company crossed the 1,000 BTC milestone.

With this level of institutional accumulation, a new ATH seems more like a question of when, not if.

Network Hashrate Stabilizes Just Below 900 EH/s

On June 13th, the Bitcoin network reached a new all-time high of 950 EH/s, only to experience one of its most aggressive drops, falling to 802 EH/s—a decline of 148 EH/s, or 15.6%.

The sharp drop was driven by brutal heatwaves across parts of North America, which forced many miners to curtail operations. These reductions, often voluntary or mandated through demand response agreements with grid operators, significantly reduced competition for block rewards. It appears the worst of the curtailment is behind us. The network hashrate has since recovered to 891 EH/s, signalling that many miners are coming back online.

Biggest Difficulty Drop Since China Ban Brings Relief to Bitcoin Miners

Amid summer curtailment, the Bitcoin network saw its largest difficulty adjustment in three years, offering a rare boost for miners who managed to stay online. On June 29th, Bitcoin’s mining difficulty dropped by -7.48%, marking the steepest decline since July 2021, when China’s nationwide mining ban abruptly took over half the network offline. This time, it wasn’t geopolitics, but weather that drove the disruption.

The adjustment has brought a much-needed reprieve to miners who remained operational, especially those outside of the heat-affected regions. As a result, hashprice jumped 8.2%, pushing it to $58/PH/day, a level not seen in several weeks.

With an estimated upward adjustment of around 7% coming Saturday, the bump in hashprice is likely temporary, it underscores the importance of weather-related volatility in today’s global mining industry, and how miners who can remain online during peak grid stress events can benefit significantly from such network-level adjustments.

Cango and IREN Join the +50 EH/s Club

In just 18 months, IREN has energized over 600MW of infrastructure and grown its self-mining capacity from 5.6 to 50 EH/s. At the end of June Cango completed its acquisition of 18 EH/s of active hashrate from, Antalpha, pushing its total installed hashrate to 50 EH/s. With those milestones, IREN and Cango officially join the +50 EH/s club, standing alongside MARA and CleanSpark.

Collectively, these four public mining giants now operate more than 208 EH/s—accounting for nearly 60% of all public miner hashrate and 25% of Bitcoin’s total network hashrate. While IREN’s focus is now on their 50MW AI data center in Texas set for delivery in the fourth quarter, MARA is going all-in on mining and set a new target of 75 EH/s by the end of the year.

The hashrate production by the top 4 miners is impressive but should be a wake-up call as well. Industrial-scale mining is becoming increasingly concentrated. As hashrate consolidates into fewer hands, it makes one wonder does too much hashrate in too few companies become a systemic risk?

Tether Targets the Top Spot With a Latin American Footprint

Tether aims to become the world’s largest Bitcoin miner by the end of 2025, and Latin America is at the heart of its expansion strategy. The stablecoin giant has quietly built a presence across the region, leveraging abundant and underutilized renewable energy to power its mining ambitions.

Since 2023, Tether has partnered on mining operations in Uruguay, Paraguay, El Salvador. Last week the company announced they will start mining in Brazil and the company is hiring an Expansion Manager for Argentina to grow its services, including Tether Power. Each site is strategically located near renewable energy sources—hydropower in Paraguay, wind in Uruguay, geothermal in El Salvador, and surplus renewables from agribusiness operations in Brazil.

The scale of Tether’s commitment is substantial. The company has pledged over $2 billion toward mining and energy infrastructure, with plans to scale capacity from an initial 120 MW to 450 MW across at least 15 sites. Tether’s CEO Paolo Ardoino made it clear: this isn’t just about profits, it’s about securing the Bitcoin network. With over 100,000 BTC on its balance sheet, Tether sees mining as a way to vertically integrate and support the asset backing its core business.

In Brazil, Tether recently announced a partnership with Adecoagro to tap into surplus power from sugar and ethanol production. Combined with its stake in El Salvador’s Volcano Energy project and previous announcements in Uruguay and Paraguay, Tether is building one of the most geographically diversified and renewably powered mining portfolios in the world.

Whether it can truly surpass the likes of MARA or CleanSpark remains to be seen, but the ambition is undeniable. As of now, Tether is estimated to operate around 25 EH/s. While that's a significant footprint it still leaves a steep climb if Tether intends to surpass MARA’s 75 EH/s target by year’s end. To do so, Tether would need to triple its current hashrate in under six months. Given its multibillion-dollar investment pipeline and active site development across Latin America, the ambition is not out of reach, but it will require rapid execution and continued expansion of its energy partnerships to hit that milestone in time.

Are We Witnessing a Corporate Treasury Altseason?

Bitcoin has long dominated the conversation around corporate treasuries, but a new wave is quietly building, Ethereum is beginning to emerge as a treasury-grade asset. In past crypto cycles, we saw capital rotate from Bitcoin into altcoins, largely driven by retail speculation. This time, however, the shift appears to be led by public companies.

SharpLink Gaming made headlines after announcing a major Ethereum allocation. The news sent its stock surging over 300%, and the company now holds a staggering 188,478 ETH. BitMine Immersion Technologies followed with a $250 million capital raise to establish its own ETH treasury, and in a move that signals strategic intent, Fundstrat’s Tom Lee has joined the firm as Chairman. Meanwhile, Bit Digital is winding down its Bitcoin mining operations altogether, redirecting its focus toward Ethereum staking. The company currently holds 24,434 ETH and has signaled plans to convert its remaining BTC reserves.

Momentum isn’t limited to Ethereum. Upexi also saw its stock rally after announcing plans to acquire Solana, a move that underscores growing institutional interest in altcoins beyond Bitcoin. Is this the beginning of an institutional altseason? If history is any guide, capital chasing the next breakout narrative often end in sharp corrections.

The following content is exclusively for our Premium Members:

U.S. lawmakers just passed the One “Big Beautiful Bill,” a sweeping pro-business tax package that includes a major win for capital-intensive industries, the full return of 100% bonus depreciation. In our premium section we discuss how miners can benefit from this.

Esports Giant Ninjas in Pyjamas Buys Bitcoin Miners, Expects Monthly Production of $6.5M in BTC

Trump-linked American Bitcoin raises $220M for mining

Tether and Adecoagro To Power Bitcoin Mining With Renewable Energy In Brazil

Hut 8 Secures 5-Year Capacity Contracts for 310 MW

Argo Blockchain shares crash 62% as restructuring plan wipes out existing investors

Leverage data-driven insights and a powerful network to launch strong, optimize efficiently, and scale with confidence. We offer:

Market Intelligence - Masterclasses, Tailored Reports & Articles and Industry Benchmarks.

Advisory Services - Business Plan Assessment, Investor Presentations, M&A Advisory and Executive Coaching.

Sites & Rackspace - Due Diligence & Partnership Matchmaking, Institutional Investment Guidance and Rackspace Sales

Elevate your mining operation today with Digital Mining Solutions!

If you enjoy the content, if you have not subscribed, please ensure to click the button below and share The Bitcoin Mining Block Post.

If you want to stay ahead in the world of Bitcoin mining, make sure to follow me on Twitter and LinkedIn. Would you like to become a sponsor of the newsletter or are you interested in a workshop on mining economics? Contact me at nicosmid@digitalminingsolutions.tech.