Cloud mining, the concept of renting computing power from data centers to mine cryptocurrencies remotely, has long walked a tightrope between innovation and controversy. Initially celebrated as a way to democratize access to Bitcoin mining, it soon earned a poor reputation due to scams, lack of transparency, and misaligned incentives. But now, in the post-2024 halving landscape, cloud mining is quietly making a comeback. Market conditions and intense competition are driving growing demand for alternative ways to gain exposure to mining returns.

A Brief History of Cloud Mining

Not Your ASIC, Not Your Hash

The Return of Cloud Mining

Mining Pools Offering Cloud Mining Services

Premium Members Only:

Hashrate Marketplaces vs. Cloud Mining

NiceHash - More than a mining pool!

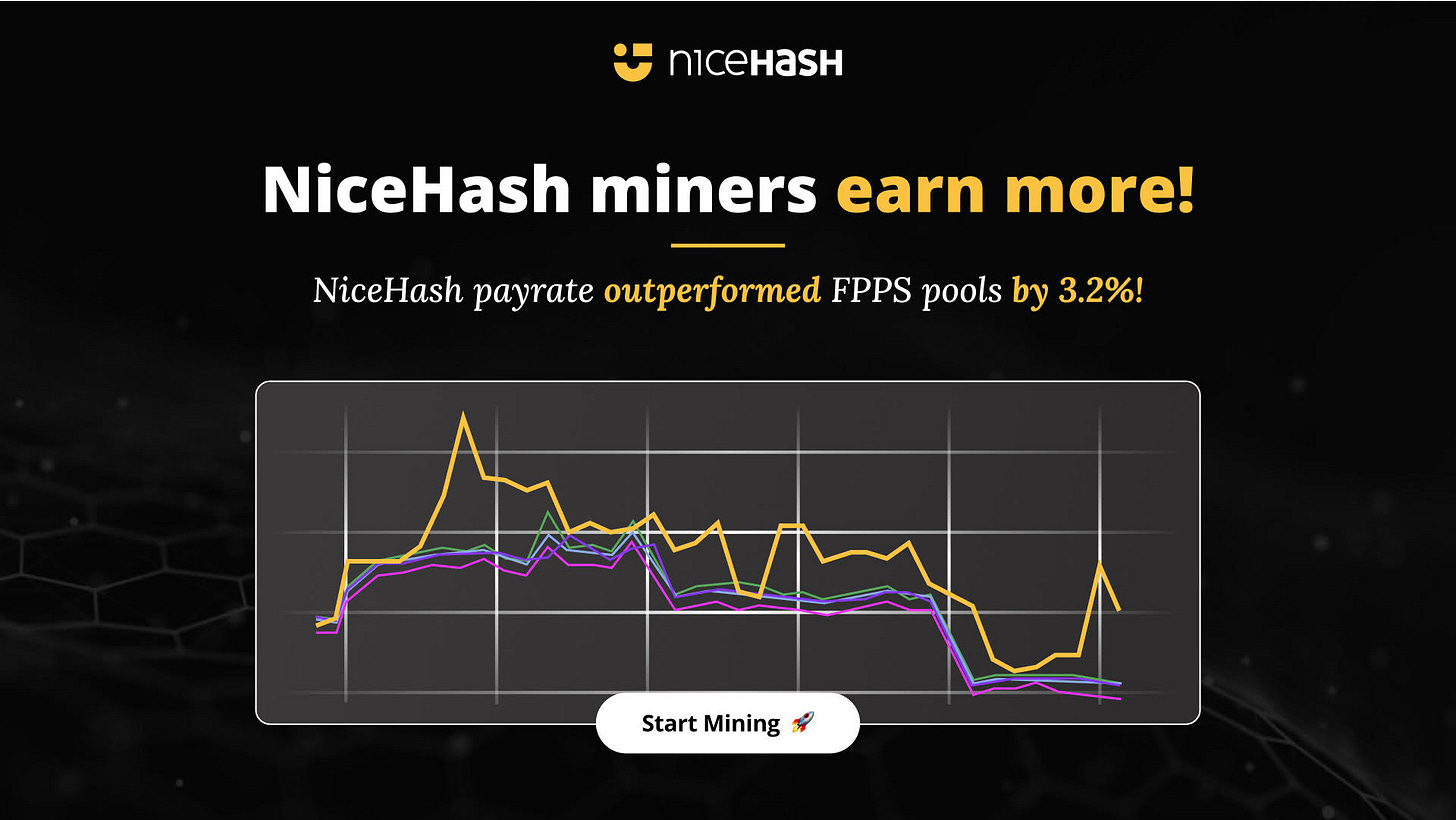

Miners on NiceHash have earned 3.2% more than on other leading FPPS Bitcoin mining pool.

Connect your ASIC machine to NiceHash and earn more!

A Brief History of Cloud Mining

Cloud mining first emerged around 2014 as an attractive alternative for individuals who wanted to participate in Bitcoin mining without the technical hassle and upfront investment in ASIC machines. Companies like Genesis Mining and Hashflare popularized the model, allowing users to buy contracts that promised a share of mined Bitcoin over a fixed term.

However, many early providers overpromised and underdelivered. Contracts were often not transparent, fees were hidden, and in some cases, there was no actual hashing going on. So-called “ponzi-mining” operations simply used new user funds to pay out existing ones. With the 2017 bull run, the industry saw a spike in interest and in scams. When the market crashed in 2018, many cloud mining operations disappeared overnight.

The lack of regulation, absence of user control, and non-custodial nature of contracts contributed to the cloud mining damaging image. It became common wisdom in the crypto space that “cloud mining is always a scam,” and for a while, that wasn’t far from the truth.

Not Your ASIC, Not Your Hash

The cloud mining backlash coincided with a broader ideological shift in Bitcoin. Around 2021, the phrase “Not your ASIC, not your hash” gained popularity, borrowing from the well-known mantra “Not your keys, not your coins.” The idea was simple: if you don’t physically control the ASIC, you don’t really own the hashpower, and therefore have no sovereignty over your mining income or risk exposure.

This ethos gave rise to the "buy and host" model, where investors purchase ASICs and co-located them in third-party facilities. It appeared to offer more transparency and ownership, but as many found out, it came with its own pitfalls. Hosting providers could mismanage power contracts, delay deployment, charge excessive maintenance fees, or even go bankrupt. In some cases, miners discovered their machines were not even plugged in or were being used by the host for their own benefit.

Over recent years it became clear that “ownership” of mining hardware does not guarantee profitability or security. Although a recent poll by Digital Mining Solutions on LinkedIn indicated that the Buy & Host model is far from dead, investors are reconsidering alternatives especially those offering liquidity, flexibility, reduced operational overhead and a lower upfront investment.

The Return of Cloud Mining

Fast forward to 2025, and cloud mining is experiencing a cautious revival, particularly among retail investors and institutions seeking capital-light exposure to Bitcoin mining. What’s different this time?

Public and big private companies leading the way

Cloud mining is no longer limited to shady startups. Publicly traded companies like BitFuFu and well-capitalized private firms like HashWhale are leading a more professional wave of service providers. BitFuFu, which spun out of a partnership with Bitmain, went public on NASDAQ and offers hashpower contracts backed by real infrastructure. Its financial disclosures offer a level of transparency not seen in the earlier cloud mining era.

HashWhale, a private mining firm with large-scale deployments across North America and the Middle East, launched its cloud mining platform in 2024. It appeals to both retail and institutional investors and has built trust through regular audits, real-time monitoring dashboards, and flexible contract terms.

Strategic Flexibility for Mining Operators

From the operator’s perspective, cloud mining now plays a dual strategic role. In low-demand or bearish markets, miners may prefer to self-mine and hold BTC, betting on price appreciation. But when market demand for hashpower surges, such as during bull runs or periods of higher hashprice, selling hashpower to cloud mining customers becomes a more attractive option.

This flexibility allows mining companies to dynamically allocate resources between self-mining and hashpower sales based on profitability, market liquidity, and investor appetite. It’s a hedge, a revenue optimization tool, and a customer acquisition funnel all at once. In effect, cloud mining becomes part of the toolkit for agile, vertically integrated mining businesses.

Mining Pools Offering Cloud Mining Services

An increasing number of mining pools, including Antpool, ViaBTC, and Binance Pool, have expanded into cloud mining. There are several strategic reasons driving this move.

One key motivation is revenue diversification. Cloud mining contracts typically offer high margins, as they allow pools to sell hashrate at a premium to retail and institutional clients.

Investors are also showing growing interest in Bitcoin mining exposure without the burden of managing physical hardware. Mining pools are well-positioned to meet this demand, thanks to their large user bases and ability to integrate cloud mining into their existing services.

Additionally, some pools have close ties to major ASIC manufacturers. Antpool and BitFuFu, for instance, are affiliated with Bitmain, giving them preferential access to new machines, large-scale hosting facilities, and operational expertise. For these players, offering cloud mining is a natural step toward vertical integration, covering everything from chip design and hardware to mining software and retail distribution.

Hashrate Marketplaces vs. Cloud Mining

While cloud mining has become more professionalized, another parallel innovation has been quietly gaining traction: hashrate marketplaces. These platforms offer a different model for accessing mining exposure...

Leverage data-driven insights and a powerful network to launch strong, optimize efficiently, and scale with confidence. We offer:

Market Intelligence - Masterclasses, Tailored Reports & Articles and Industry Benchmarks.

Advisory Services - Business Plan Assessment, Investor Presentations, M&A Advisory and Executive Coaching.

Sites & Rackspace - Due Diligence & Partnership Matchmaking, Institutional Investment Guidance and Rackspace Sales

Elevate your mining operation today with Digital Mining Solutions!

If you enjoy the content, if you have not subscribed, please ensure to click the button below and share The Bitcoin Mining Block Post.

If you want to stay ahead in the world of Bitcoin mining, make sure to follow me on Twitter and LinkedIn. Would you like to become a sponsor of the newsletter or are you interested in a workshop on mining economics? Contact me at nicosmid@digitalminingsolutions.tech.