Will USDT on RGB Change Transaction Fees and Miner Economics?

Can Tether Bring Miners Fresh Revenue?

For much of 2023 and 2024, Bitcoin miners enjoyed elevated transaction fees thanks to the frenzy around Ordinals inscriptions and BRC-20 tokens, which pushed block space demand to levels not seen in years. Fast forward to late 2025, and the picture looks very different. As hype around Ordinals has waned and transaction slowed, miners once again find themselves heavily reliant on the block subsidy. Last week Tether announced the launch of USDT on Bitcoin, using the RGB protocol. Will this new stablecoin layer bring a flood of transactions (and much-needed fee revenue) back to the base layer? Or will it follow a different path, keeping activity largely off-chain? Let’s dive in.

What is RGB and Why Tether Chose It

Untapped Potential of Stablecoin Integration

Will This Increase Bitcoin Base Layer Transactions?

What’s in It for Miners?

How Could Tether on RGB Still Drive Miner Fees?

Premium Members Only:

Paths to Higher Fees Beyond RGB

“Repatriation” of Ordinals to Bitcoin

Increased Volume at Cycle Tops

Proof-of-Reserves 2.0: Making Custodians More Transparent

Compliance Data Anchoring

Waves of Self-Custody Due to Payments & Capital Controls

‼️NiceHash Firmware fee reduced to just 0.6%‼️ From now until September 30th, only:

👉 0.6% fee when mining on NiceHash pool,

👉 1.2% fee for 3rd-party pools.

Supported algorithms: SHA-256 (Bitcoin) and Scrypt.

What is RGB and Why Tether Chose It

The RGB protocol is a Layer-2 framework designed to enable asset issuance (such as stablecoins) on Bitcoin without clogging its base layer. It operates on the principle of client-side validation, which means that most transaction data lives off-chain in user wallets. Only compact cryptographic commitments (tiny proofs) are periodically anchored to the Bitcoin blockchain.

This design achieves several important outcomes:

Privacy: Transactions remain visible only to the counterparties involved, not broadcast to the global Bitcoin network.

Scalability: Since only minimal data is posted on-chain, Bitcoin doesn’t get congested, even if millions of RGB transactions occur.

Lightning Compatibility: RGB integrates with the Lightning Network, allowing stablecoin payments to flow as quickly and cheaply as BTC payments.

For Tether, which has historically deployed USDT across multiple blockchains (Ethereum, Tron, Solana, etc.), RGB offers a way to tap into Bitcoin’s security and credibility without paying the high cost of on-chain scaling.

Untapped Potential of Stablecoin Integration

According to The Currency Analytics, over 30% of institutional Bitcoin holdings are already paired with stablecoin strategies. By combining Bitcoin’s security with stablecoin flexibility, institutions gain a scalable, compliant, and hedgeable financial instrument. Global remittance providers and cross-border payment platforms stand to benefit as well. Leveraging Bitcoin’s base layer while reducing reliance on intermediaries is particularly valuable in emerging markets, where access to traditional banking remains limited. Together, Bitcoin and USDT can expand financial inclusion by offering secure, low-cost, and programmable financial services.

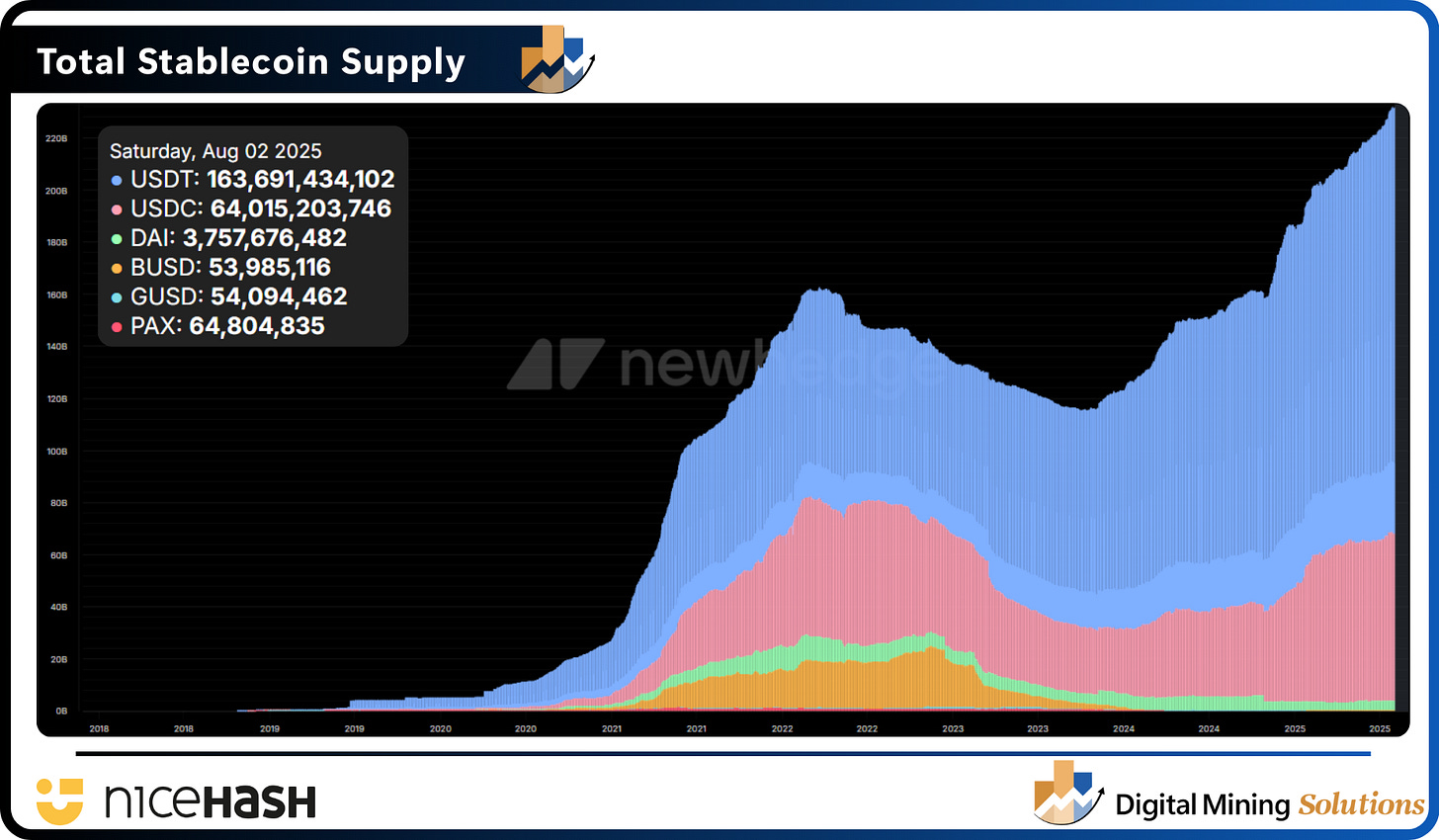

The total stablecoin market capitalization is approximately $410 billion. With a 40% market share, Tether has both credibility and resources to drive adoption. Its financial strength allows investment in RGB-compatible wallets, merchant platforms, and cross-chain bridges.

Will This Increase Bitcoin Base Layer Transactions?

RGB is explicitly designed to minimize on-chain footprint. Unlike ERC-20 tokens on Ethereum, where every token transfer is a full blockchain transaction, RGB transactions are off-chain by default. Only small commitments, used to prove the state of ownership, get written to the blockchain.

That means the daily flow of USDT transfers on RGB will not show up as an explosion of Bitcoin base layer transactions. Instead, we’ll likely see occasional anchor transactions for issuance or settlement, compact proof commitments spread across blocks, and integration with Lightning, keeping most activity off-chain. In short, USDT on RGB is unlikely to meaningfully lift base layer transaction counts.

What’s in It for Miners?

Tether on RGB will likely not spark a new fee boom for miners. It’s the opposite of Ordinals: designed to avoid fee spikes. Even if it doesn’t drive miner revenue higher, Tether’s move is still a landmark for Bitcoin. Until now, Bitcoin has been largely left out of the $100+ billion stablecoin market dominated by Ethereum and Tron. With RGB, Bitcoin can finally host stablecoins natively. USDT is one of the most used payment rails worldwide, including in the Bitcoin mining industry.

One of the biggest frictions for miners and hosting clients has always been juggling multiple wallets to manage income and expenses. With USDT and BTC available in the same wallet, this process becomes seamless: you earn in Bitcoin and pay hosting fees in stablecoins within the same platform. No more moving funds through exchanges, paying extra conversion fees. With everything consolidated into one interface, clearer visibility is given into mining revenues and costs. The end result is a smoother, more transparent experience for both miners and hosting clients.

How Could Tether on RGB Still Drive Miner Fees?

In the short term, the real significance isn’t higher fees but the expansion of Bitcoin’s utility. Over the longer run, however, the key question is: under what scenarios could Tether on RGB still drive more base layer activity and ultimately boost miner revenues?

If USDT on RGB gains massive adoption, wallets and services might choose to anchor proofs more frequently than the protocol’s minimal requirements. Exchanges and payment processors might opt for frequent anchors to reduce counterparty risk. They might batch-settle balances on-chain at end-of-day, week, or month, depending on liquidity needs. Institutions using USDT may also require frequent on-chain commitments to meet audit or compliance standards.

Even if day-to-day USDT transfers stay off-chain, periodic onboarding and settlement events could spike activity. When new USDT is minted and distributed via RGB, initial commitments need to be recorded on Bitcoin. If Tether expands aggressively on Bitcoin, issuance bursts could appear as fee spikes.

Since RGB integrates with the Lightning Network, opening and closing Lightning channels with USDT functionality could generate significant base layer transactions. Operators might need to churn channels more often due to the higher transaction volume of stablecoins compared to BTC.

Finally, market cycles could determine whether RGB pushes more traffic on-chain. As BTC price surges, users become less fee sensitive and more frequent anchoring becomes acceptable. In periods of high volatility, users and institutions may insist on more on-chain settlement for peace of mind.

While in the short term, miners should not expect Ordinals-style fee spikes, in the medium term, predictable settlement traffic could provide a steady fee floor. Time will tell is RGB-driven fees become a structural part of the fee revenue mix.

The following content is exclusively for our Premium Members:

Paths to Higher Fees Beyond RGB

Even without RGB, there are still multiple paths that could drive heavier usage of Bitcoin’s base layer. Below are five key scenarios worth watching, each with the potential to reshape transaction demand and miner revenues.

“Repatriation” of Ordinals to Bitcoin

Increased Volume at Cycle Tops

Proof-of-Reserves 2.0: Making Custodians More Transparent

Compliance Data Anchoring

Waves of Self-Custody Due to Payments & Capital Controls

Leverage data-driven insights and a powerful network to launch strong, optimize efficiently, and scale with confidence. We offer:

Market Intelligence - Masterclasses, Tailored Reports & Articles and Industry Benchmarks.

Advisory Services - Business Plan Assessment, Investor Presentations, M&A Advisory and Executive Coaching.

Sites & Rackspace - Due Diligence & Partnership Matchmaking, Institutional Investment Guidance and Rackspace Sales

Elevate your mining operation today with Digital Mining Solutions!

If you enjoy the content, if you have not subscribed, please ensure to click the button below and share The Bitcoin Mining Block Post.

If you want to stay ahead in the world of Bitcoin mining, make sure to follow me on Twitter and LinkedIn. Would you like to become a sponsor of the newsletter or are you interested in a workshop on mining economics? Contact me at nicosmid@digitalminingsolutions.tech.